For years, institutional investors and nation-states have debated the merits of Bitcoin as a strategic reserve. Yet, according to leading crypto entrepreneur Mike Alfred, the US government is dragging its feet – not accumulating Bitcoin for reserves until major geopolitical competitors take the first step. This dynamic of institutional inertia is creating fertile ground for retail investors to find opportunity further down the risk curve, especially within altcoins, meme projects, and experimental blockchain utility tokens.

“Institutional sluggishness in crypto creates a window for retail to get ahead—especially in NFT, meme, and AI-infused coins that are too fast or small for government playbooks.”

— Paraphrased from Mike Alfred’s public commentary on US Bitcoin reserves

But with new cycles come new narratives. Today, projects like DeepSnitch AI (DSNT) and Pi Network (PI) are challenging the classic meme coin, exemplified by Shiba Inu (SHIB), not only with bolder upside narratives but also with real-world utility and technological differentiation.

Shiba Inu (SHIB): Price Prediction and Evolution by 2026

Shiba Inu, once synonymous with astonishing 10,000%+ gains during the meme coin explosion, now walks a different path in the 2020s. After years of wild volatility and headline-making returns, SHIB has matured into a “legacy meme coin.” Its sprawling global community, persistent social media buzz, and acceptance as a joke-turned-brand have given it staying power in the public imagination.

Current Performance and Market Sentiment

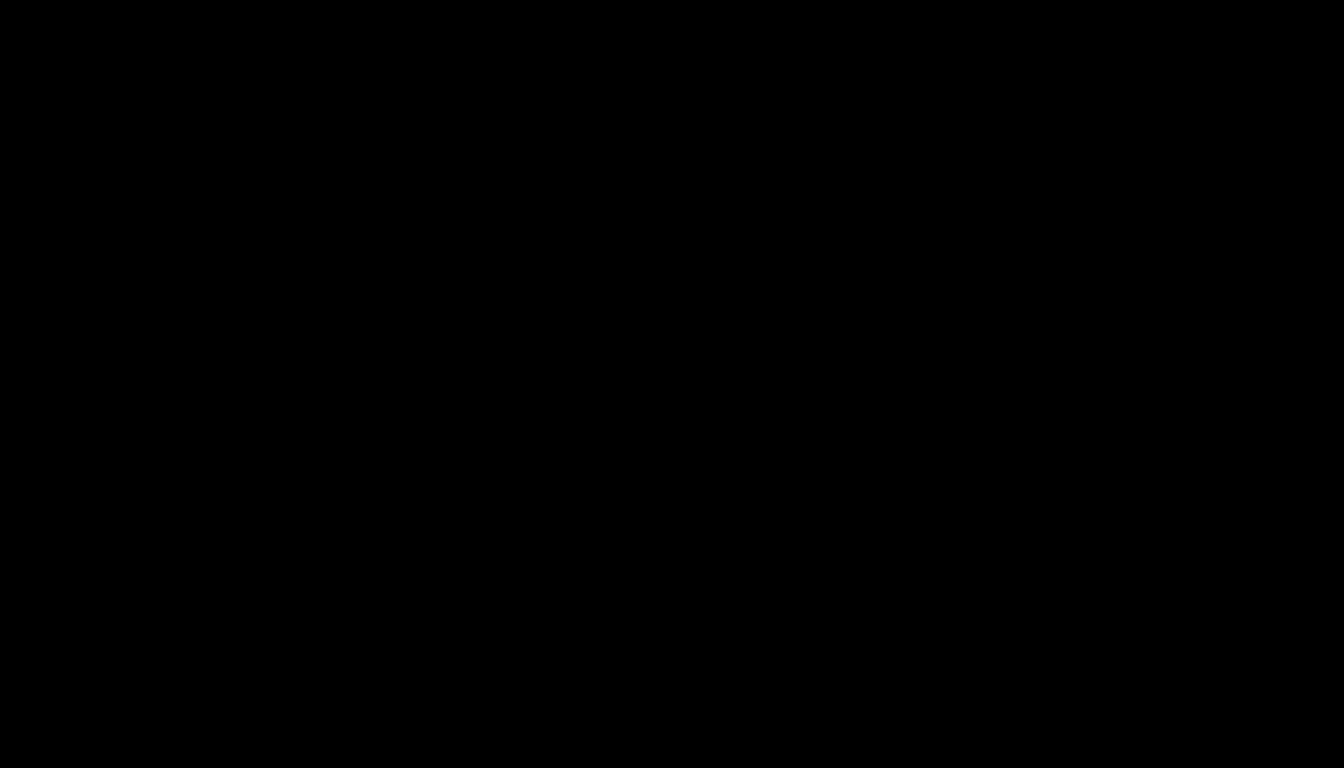

Recently, Shiba Inu has trailed the broader altcoin market, experiencing mild pullbacks—often single-digit percentage declines—amid shifting sentiment toward more utility-driven tokens. Compared with its past, the current risk/reward narrative around SHIB is notably muted.

SHIB 2026 Price Outlook

Most mid-term forecasts for Shiba Inu suggest a modest upside into 2026—roughly 20% gains from current levels. This aligns with its now-enormous market cap and the headwinds faced by all mature meme tokens: dramatic outperformance becomes harder as a coin grows. Analysts see SHIB as a potential “hold or hedge” against the broader crypto market rather than a ticket to outsized wealth creation.

Despite this, SHIB remains culturally significant, serving as a critical comparison point for any new meme coin or hybrid token. Its community, history, and “benchmark” status mean it sets the bar against which fresh contenders are measured.

DeepSnitch AI (DSNT): “Meme Coin With Utility” and the 600x Speculation

Beneath the surface of meme coin hype, DeepSnitch AI offers something new—a crossover narrative that blends viral meme appeal with AI-driven trading tools. Tapping both the irreverent fun of internet culture and the ambitions of the AI revolution, DSNT has rapidly gained momentum in early fundraising.

Presale Traction and Market Position

DeepSnitch AI’s presale has reportedly raised over $555,000, with the token offered at a presale price of just under 2.5 cents. Early participants have already logged double-digit percentage gains from this modest starting point, enflaming the “moonshot” narrative typical of high-risk crypto launches.

AI-Powered Utility Suite: Bridging Hype and Usefulness

The strength of DSNT lies in its technology stack—five flagship AI agents built for market intelligence and crypto trading:

- SnitchScan: Scans on-chain activity for market anomalies, whale moves, and hidden opportunities.

- SnitchFeed: Curates AI-enhanced news and actionable signals.

- SnitchCast: Provides AI-driven audio/video commentary on crypto trends.

- AuditSnitch: Offers rapid contract and token due diligence.

- SnitchGPT: Adds a conversational interface for customized analytics and real-time market Q&A.

This suite moves DSNT beyond pure meme status. It positions the project as “the first meme coin with real trader tools,” leveraging AI buzz to increase adoption and engagement.

The 600x Upside Narrative: How Realistic?

From a sub-$0.03 entry, popular speculation around DeepSnitch AI imagines a 600x rally—potentially lifting DSNT into the $14+ price range per token. Of course, such returns are extremely rare, highly speculative, and hinge on perfect execution, viral growth, and a ripe macro environment. Memecoins (including SHIB) have gone exponential in prior cycles, but many more have faded to zero.

What sets DSNT apart is its 30% marketing allocation, echoing the classic playbook of meme and viral coins: saturate social media, incentivize influencers, and drive sharing. Historically, such budgets can spark rapid community growth and price appreciation—but also magnify risks if narratives falter or utility lags.

Pi Network (PI): Real Utility, L1 Ambition, and Moderate Upside

Unlike the meme-heavy branding of SHIB and DSNT, Pi Network is laying the groundwork for a utility-driven blockchain. It is currently focused on expanding its base layer (L1) protocol, ecosystem, and real-world utility rather than short-term speculation.

Growth Through Utility and Community

Pi Network’s most significant achievement so far is its broad user acquisition during development; it boasts millions of registered users and active participants in early app phases. When external crypto markets have weakened, Pi Network has shown resilience—some weeks even posting positive returns thanks to surges in speculative demand.

PI Price Forecast for 2026

Analyst consensus is cautiously optimistic about PI, with some projecting over 100% upside into 2026—much stronger than SHIB’s mid-term expectations, though still far from DSNT’s headline-grabbing 600x narrative. The logic is clear: platforms with real utility and token demand—especially new L1 blockchains—can dramatically outperform in bullish cycles, provided they attract developers and users.

In the ecosystem hierarchy, PI sits alongside other infrastructure and application layer projects aiming to deliver real-world value instead of just meme-fueled speculation. For investors, this creates a differentiated risk/reward profile: potentially stronger returns than legacy meme coins on a risk-adjusted basis, with lower probability of a “blow-off top” like early-stage memes.

Strategic Comparison: Investment Angles and Risks

US Government Stance vs Retail Agility

The prevailing caution among US institutions on Bitcoin—paralleling Mike Alfred’s point about strategic reserves—solidifies a cycle where retail leads experimentation. Large funds and governments may eventually build positions in blue chips like BTC and ETH, but by then, the high reward-to-risk altcoin window often closes. This gives everyday investors a shot at breakthroughs in narratives (AI, meme, L1) inaccessible to institutional slow movers.

Comparing SHIB, DSNT, and PI

| Project | 2026 Price Outlook | Utility/Use Case | Risk/Reward | Investment Narrative |

|—————-|——————-|——————————-|——————————-|—————————–|

| Shiba Inu (SHIB)| ~20% modest gain | Benchmark meme coin, low utility| Lower risk, lower upside | “Hold or hedge” |

| DeepSnitch AI (DSNT)| 600x (speculative only) | AI trading tools + meme dynamics| High risk, high theoretical upside | Meme+Utility moonshot |

| Pi Network (PI)| ~100%+ possible gain| L1 utility, mainstream adoption| Moderate risk, moderate-high return | Early-phase infrastructure |

Critical Factors for Altcoin Investors

No matter the narrative, several fundamentals underlie all crypto investing:

- Speculative Stories Win Attention: 600x hype is powerful for viral momentum but can breed unsustainable FOMO.

- Utility Drives Longevity: Projects offering on-chain tools and real user engagement (PI, DSNT) may outlast hype-driven competitors.

- Tokenomics and Marketing Matter: Aggressive marketing budgets often precede explosive rallies, but can also accelerate post-hype crashes.

- Risk Management is Essential: Most coins, especially early-stage or meme-heavy projects, carry a real possibility of sharp drawdowns or total loss.

Conclusion: Navigating The Next Crypto Cycle

Shiba Inu, DeepSnitch AI, and Pi Network each represent a different stage and style of crypto investing. SHIB, as the grizzled meme veteran, now offers stability and cultural cachet but only modest upside. DSNT, straddling the line between meme and utility, embodies everything speculative and experimental in today’s crypto cycles—its 600x potential entirely hypothetical and fraught with risk. Meanwhile, Pi Network demonstrates how early-stage, utility-driven L1s can outperform legacy meme narratives on a risk-adjusted basis.

The hesitation of US institutions to embrace Bitcoin opens a window for retail investors to explore new narratives and higher-upside plays. Yet, no matter the project—whether chasing memes or betting on infrastructure—success demands research, diversification, and prudent risk management. Only by understanding both the promises and dangers of crypto cycles can investors find their edge in a fast-moving market.

FAQs

What is the Shiba Inu price prediction for 2026?

Most analysts forecast a modest gain for Shiba Inu by 2026, generally around 20% growth from current prices. The era of explosive 10,000% returns is widely viewed as over, given SHIB’s high market cap and mature status.

What is the 600x upside narrative for DeepSnitch AI, and how risky is it?

The 600x upside scenario envisions DSNT’s price multiplying to double digits from its early cents-level presale, driven by meme momentum and an AI-powered utility suite. This is a highly speculative possibility, relying on viral marketing, adoption, and favorable market trends, and carries significant risk of large losses.

How does Pi Network’s 2026 outlook compare to other altcoins?

Pi Network could see over 100% upside by late 2026, particularly as its infrastructure and utility develop. While less meteoric than meme coin moonshots, this performance outpaces expectations for legacy meme projects and highlights the appeal of utility-led blockchain platforms.

Are meme coins or AI utility coins better investments?

AI utility coins like DSNT offer both the viral potential of memes and the staying power of real-world use cases. However, meme coins like SHIB have proven staying power through strong communities—each category has distinct risks and opportunities.

How does US Bitcoin reserve policy impact crypto markets?

Institutional hesitancy—such as the US government’s reluctance to accumulate BTC reserves—means retail investors often lead the way in new sectors. When institutions eventually enter, much of the upside in newer, riskier tokens may have already played out.