Tyler Winklevoss, along with his identical twin Cameron, is a name synonymous with early Facebook history and the meteoric rise of cryptocurrency. Yet, how much is Tyler Winklevoss worth? The answer to this question is as intriguing as his journey—from rowing in the Olympics to becoming one of the most prominent Bitcoin billionaires. Examining his wealth offers insights not only into the accumulation of modern digital fortunes but also the volatility, risks, and potential that define tech-driven investing today.

The Building Blocks: Tyler Winklevoss’s Early Wealth

The Facebook Settlement

Tyler Winklevoss’s wealth narrative famously begins on the Harvard campus, where he, his brother Cameron, and classmate Divya Narendra conceived “ConnectU,” an early social network. As is well-documented, Facebook’s rise led to legal battles over intellectual property. In 2008, the Winklevoss twins settled with Mark Zuckerberg for a combination of cash and Facebook stock. Reports from the era estimate this settlement at $65 million, split between approximately $20 million in cash and $45 million in stock.

The eventual value of that Facebook stock fluctuated with the company’s pre-IPO and post-IPO performance. There is public evidence that the twins retained significant Facebook shares until at least 2011, ensuring their initial fortune grew as social media exploded in value.

Olympic Ambitions and Early Investments

Tyler’s fame extended beyond technology. As an Olympic rower, he competed for the United States in 2008, embodying a blend of athletic discipline and strategic thinking later evident in his business pursuits. Throughout the early 2010s, the twins diversified their investments into various startups and technology companies, quietly growing their portfolio.

The Bitcoin Leap: A Revolutionary Wealth Strategy

Early Conviction and Bulk Investments

One of the most pivotal points in estimating Tyler Winklevoss’s net worth centers on his and Cameron’s early, audacious bet on Bitcoin. They started acquiring Bitcoin in 2012, at a time when mainstream financial media often dismissed cryptocurrencies as a fringe speculation. Reports and interviews suggest the twins invested close to $11 million in Bitcoin between 2012 and 2013, accumulating upwards of 100,000 BTC—an astonishing sum at the time.

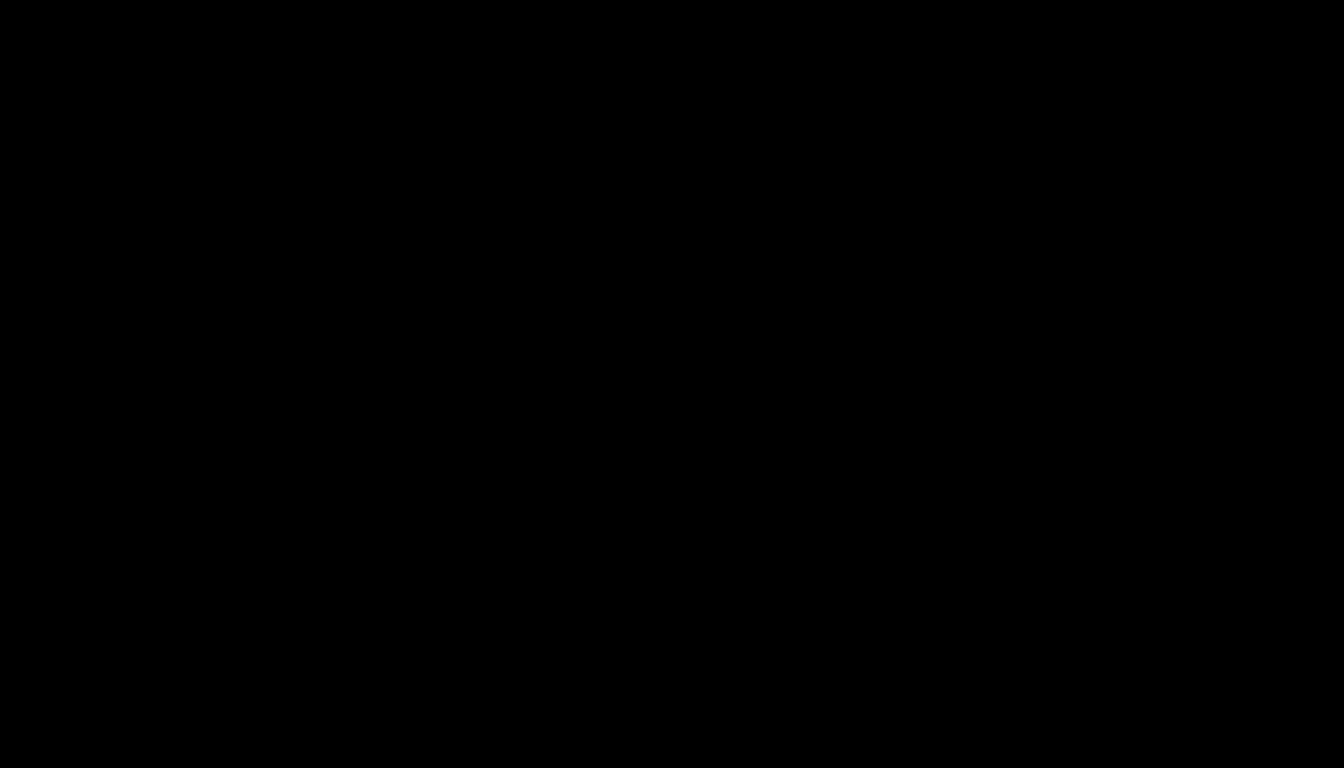

Bitcoin’s Wild Ride and Net Worth Calculations

Given Bitcoin’s highly volatile price history, the value of this holding has fluctuated dramatically:

- At Bitcoin’s 2017 high: With Bitcoin peaking near $20,000, the twins’ collective stake reached hand-calculated billionaire status.

- 2021–2022 “Crypto Boom”: During the bull run, as Bitcoin topped $60,000, each twin’s share potentially surpassed $3 billion. This placed Tyler among the world’s wealthiest crypto holders.

- Market Corrections: During bear markets, their net worth can fall sharply, illustrating the risks inherent to crypto-dominant portfolios.

The twins have regularly stated they retain the majority of their original holdings. That said, net worth figures for Tyler Winklevoss depend heavily on current Bitcoin prices and are subject to rapid change.

“Tyler Winklevoss’s net worth is a testament to the conviction and risk appetite required not just to ride the crypto wave, but to shape it—from Facebook’s courtroom dramas to pioneering institutional adoption of Bitcoin.”

—Crypto industry analyst

Gemini: Transforming Wealth into a Regulated Enterprise

Founding and Scaling a Crypto Exchange

In 2014, Tyler and Cameron launched Gemini, a digital asset exchange engineered for regulatory compliance and institutional credibility. Gemini quickly positioned itself as one of the leading U.S.-based platforms, expanding services from Bitcoin and Ethereum trading to stablecoins and NFT markets.

Gemini’s business model generates revenue through transaction fees and institutional partnerships. While private, the company has achieved “unicorn” status—valued at over $1 billion at various funding rounds. Tyler’s significant ownership stake in Gemini further enhances his overall net worth, and diversifies the Winklevoss wealth beyond direct crypto holdings alone.

Adapting Amid Regulatory Scrutiny

Operating Gemini has not been without regulatory and operational challenges. Increased scrutiny on digital asset exchanges, changing U.S. policies, and fierce competition from giants like Coinbase and Binance create ongoing risks, but also underscore the authority and trust Gemini has built over time.

Diversification: Startups, NFTs, and Web3 Ventures

Expanding Beyond Crypto

Beyond Bitcoin and Gemini, Tyler Winklevoss and his brother have invested in various tech startups and Web3 initiatives. Their family office, Winklevoss Capital, has backed dozens of early-stage companies in fintech, digital media, and blockchain.

Recently, the twins have shown growing interest in NFTs (non-fungible tokens), decentralized finance (DeFi), and unique applications of blockchain technology. While these assets are far less liquid or universally valued than Bitcoin, they form another layer of Tyler’s dynamic and forward-looking portfolio.

Risks and Opportunities

By participating in these emergent spaces, Tyler assumes higher short-term risk for potentially outsized returns. However, the illiquidity and regulatory uncertainty of startups and new token markets introduce notable complexity to estimating his net worth accurately.

The Bottom Line: Current Estimates of Tyler Winklevoss’s Net Worth

Most publicly cited estimates place Tyler Winklevoss’s net worth in the range of $1 billion to $2 billion, though this is subject to rapid change due to the dominant share of assets in Bitcoin or other cryptocurrencies. When Bitcoin’s price surges, so does Tyler’s estimated net worth; during downturns, it can retreat swiftly.

Key Net Worth Drivers

- Bitcoin Holdings: The core driver, with value highly sensitive to price swings.

- Gemini Exchange: Enterprise value and growth potential tied to the crypto market cycle.

- Startup and Alternative Investments: Less visible, but potentially impactful in the long term.

When comparing Tyler Winklevoss’s net worth to other prominent crypto billionaires—such as Coinbase founder Brian Armstrong or Binance’s Changpeng Zhao—the composition is distinct. Rather than relying solely on equity in operating companies, Tyler combines direct crypto ownership with active enterprise-building and diversified venture backing.

Real-World Impact and Evolving Legacy

Tyler Winklevoss’s journey has become shorthand for the upside—and volatility—of new wealth in the internet age. His conversion of a legal settlement into a game-changing Bitcoin position, and further into a regulated financial business, highlights the relentless innovation shaping 21st-century fortunes.

Beyond personal wealth, Gemini’s regulated posture has helped foster mainstream institutional adoption of digital assets, setting blueprints for security and compliance in crypto finance.

Conclusion: Wealth in a Digital Age—Key Takeaways

Tyler Winklevoss’s net worth is not merely a static figure, but a reflection of evolving fortunes in technology and cryptocurrency. Depending on market cycles, published estimates fluctuate widely, but consistent themes remain:

- Most of his wealth is tightly bound to the fate of Bitcoin.

- The value and risks of that wealth shift with every price move and regulatory development.

- Gemini and venture holdings add both stability and additional upside—but also complexity.

For those researching prominent digital-age fortunes, Tyler Winklevoss exemplifies how early conviction, diversification, and enterprise creation can redefine modern wealth. Prudent investors should note the volatility that comes with tech-driven assets, while recognizing the strategic vision underpinning such outsized success.

FAQs

How much is Tyler Winklevoss worth today?

Estimates fluctuate due to the volatile price of Bitcoin and his significant crypto holdings. Most recent public sources place his net worth between $1 billion and $2 billion, but actual figures can be higher or lower based on market movements.

What are the main sources of Tyler Winklevoss’s wealth?

The core sources include his early settlement from Facebook, significant personal Bitcoin holdings, and his ownership stake in Gemini, a leading cryptocurrency exchange. Investments in startups and Web3 businesses also contribute to his overall portfolio.

How much Bitcoin does Tyler Winklevoss own?

Along with his brother, Tyler is believed to have purchased around 100,000 Bitcoins in the early 2010s. Their long-term holding strategy means most of this position may still be intact, but precise, up-to-date figures are not public.

How risky is Tyler Winklevoss’s wealth compared to traditional billionaires?

Because much of his net worth is tied to cryptocurrencies, it is considerably more volatile than fortunes based on more traditional assets like stocks, real estate, or enterprises with stable cash flows.

What role does Gemini play in his financial strategy?

Gemini both generates business revenue and lends legitimacy to the twins’ crypto activities, attracting institutional clients and securing regulatory approvals. As a result, the company helps to diversify and institutionalize their wealth beyond direct coin holdings.

Has Tyler Winklevoss diversified outside of cryptocurrency?

Yes, through Winklevoss Capital, he and his brother have invested in a wide array of startups across technology, financial services, and emerging Web3 sectors. These moves aim for long-term growth and risk mitigation apart from cryptocurrency market cycles.