Introduction: Understanding Pi Network’s Unique Path

In the ever-evolving world of cryptocurrencies, few projects have garnered as much intrigue and grassroots momentum as Pi Network. Launched with the ambitious goal of making cryptocurrency accessible to the masses, Pi Network has built a community of millions of “Pioneers” mining Pi through their mobile phones. As this community grows, anticipation around a pivotal milestone—the official Pi Coin listing date—continues to reach new heights.

Unlike many digital assets that launch with immediate exchange listings, Pi has taken a markedly different route. Its phased approach, which deliberately prioritizes user onboarding and network growth over rapid monetary gains, reflects both its strengths and the sources of ongoing speculation. This article consolidates the latest developments, assesses the realistic outlook for Pi Coin’s exchange debut, and outlines key considerations for users awaiting the Pi Network exchange launch.

The Evolution of Pi Network: From Vision to Reality

Early Development and User Acquisition

Pi Network began in 2019, founded by a team of Stanford PhDs aiming to democratize access to cryptocurrency. Its mobile-first mining model allowed users to claim daily Pi Coin rewards by simply verifying their presence in the app. This user-friendly approach sparked viral growth, especially in regions where blockchain adoption has lagged.

Pi’s testnet period (known as the “Enclosed Mainnet”) prioritized in-app transactions, allowing users to swap Pi for goods and services within a closed community—importantly, without full blockchain interoperability or exchange access. This deliberate restriction was meant to:

- Ensure security and stability of the network;

- Combat fake accounts and fraudulent mining;

- Incrementally build use cases and an engaged ecosystem.

Community Growth and Economic Model

By 2024, Pi Network’s registered user base reportedly numbered in the tens of millions, making it one of the most widely participated blockchain experiments worldwide. The grassroots enthusiasm is amplified by frequent social media trends and third-party price speculation, although no public token price has been set by the core team.

“Pi Network’s phased approach underscores the importance of designing crypto economies where real user activity and digital scarcity emerge organically, rather than pushing for early speculative trading.”

— Observed by several blockchain analysts covering emerging digital assets

Pi Coin Listing Date: Timeline, Rumors, and Official Updates

What Has the Pi Core Team Communicated?

The Pi Core Team operates with a “build first, list later” philosophy. There is no official exchange listing date as of June 2024. The most notable communications center on two core milestones:

- Mass KYC Completion: The Know Your Customer (KYC) process is seen as vital to ensuring that only humans (not bots/fake accounts) receive Pi rewards. Scaling up this process to millions of users has proven challenging, and its completion is a precondition for mainnet launch and listing.

- Open Mainnet Transition: The move from an “enclosed mainnet” to “open mainnet” is when the Pi blockchain will interact freely with other networks—including exchanges. The core team has stated this will only occur after KYC and ecosystem readiness targets are achieved.

Exchange Listings: What’s Real, What’s Speculation?

In the absence of a confirmed Pi Coin listing date, rumors abound. Some secondary exchanges have posted aspirational Pi trading pairs—often marked as “IOU” (I Owe You) tokens or placeholders—without endorsement from Pi’s official team. These are not backed by actual transferable Pi and pose significant risk to uninformed buyers.

The Pi Network team has repeatedly issued warnings against engaging with unofficial listing offers, clarifying that real Pi will only be tradeable post-official open mainnet launch. This policy is intended to protect community members from scams and speculative losses.

What Is Required Before an Official Pi Coin Exchange Launch?

Key Technical and Community Milestones

Before the anticipated listing, several critical objectives must be met:

- Widespread KYC Verification: With potentially tens of millions of accounts, the KYC process must be completed on a massive scale to ensure a fair launch.

- Robust Ecosystem Development: The core team seeks a vibrant marketplace—merchants, apps, and services—where Pi can be used natively, not just traded.

- Network Security and Testing: The open mainnet needs to demonstrate sustained security under realistic transactional loads.

Learning from Past Crypto Launches

Pi’s cautious approach stands in stark contrast to several high-profile crypto projects that rushed to exchanges, only to experience price volatility, technological failures, or regulatory challenges. Notably, projects with robust user communities and genuine utility (like Solana and Polygon) tend to attract more sustainable attention post-listing than those hyped solely for short-term speculation.

Real-World Expectations: What Will Happen at Launch?

Potential Listing Partners and Trading Venues

If the project attains its technical and community goals, major exchanges—both centralized (CEXs) like Binance or Coinbase, and decentralized (DEXs) such as Uniswap—may evaluate Pi listing applications. High user numbers are attractive to exchanges seeking liquidity and volume, but compliance and technical readiness will remain critical gatekeepers.

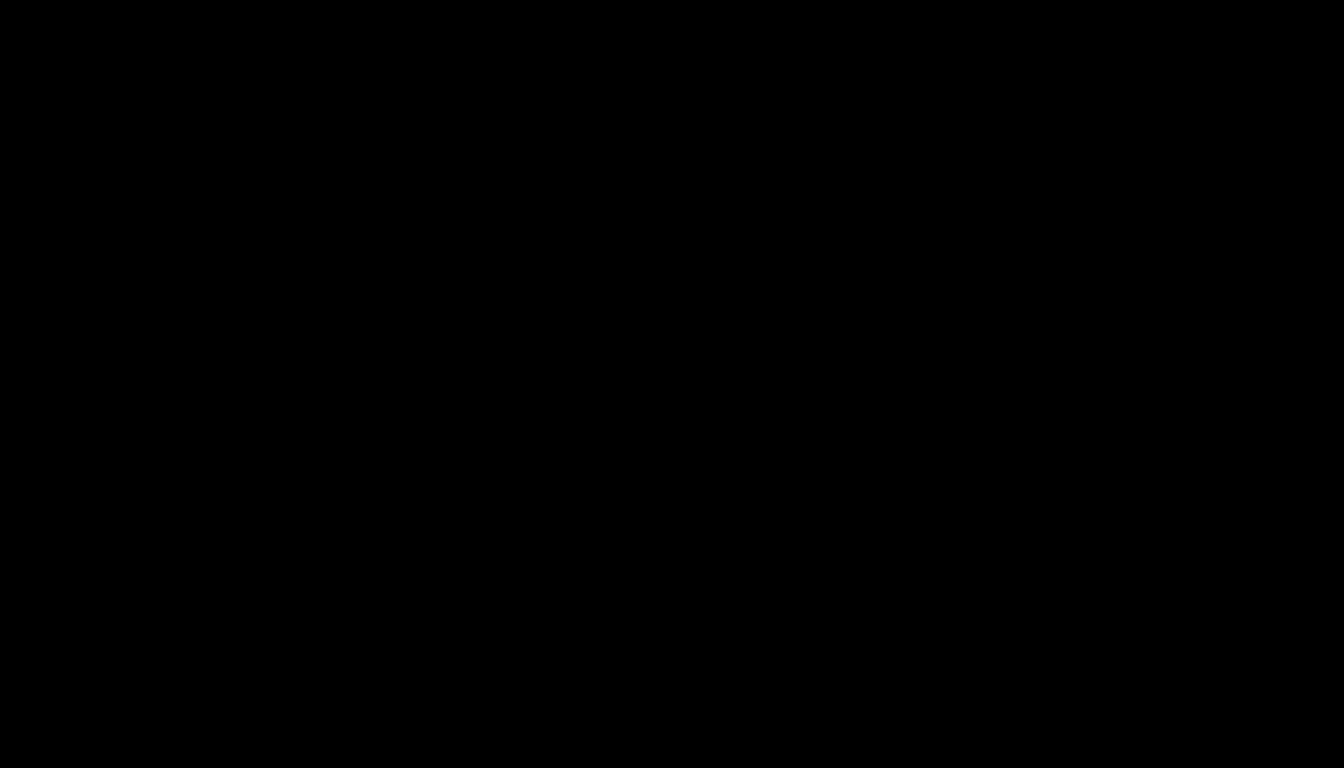

Current unofficial Pi price speculation on some corners of the internet varies widely, with some touting extravagant valuations. The core team discourages such speculation, emphasizing that the initial price will be ultimately determined by market supply and demand at the time of official listing.

How Will Pi Be Different from Typical Token Listings?

Pi intends to launch as a truly “community-first” digital asset, backed by the real economic activity of its Pioneers rather than pre-mining or venture capital majority holdings. This approach may reduce volatility and speculation, but also introduces the challenge of aligning a massive user base’s expectations with real-world utility.

Unique Aspects to Monitor:

- Distribution: The vast pre-existing user base suggests that a broader segment of the world’s population will own at least some Pi, potentially lowering entry barriers for those new to crypto.

- In-App Utility: Continued growth in the Pi ecosystem—apps, merchant offerings—may boost token value beyond technical listing.

- Regulatory Scrutiny: The sheer scale of Pi’s launch may attract additional regulatory attention, especially in major economies.

Ongoing Risks, Uncertainties, and What to Watch For

Caution Around Unofficial Channels

The Pi Network’s standing warning against using secondary markets for Pi IOUs is not just prudent—it’s necessary. The risk of scams, price manipulation, and outright theft is high in these unofficial venues.

Uncertain Timeline and User Patience

Despite widespread hope for an imminent Pi Coin listing date, the timeline depends on factors that defy simple prediction:

- Technological readiness of the blockchain

- Global completion of KYC

- Success of the Pi application ecosystem

- Third-party exchange compliance and interest

The Role of Community Trust and Communication

After years of anticipation, delays can fuel frustration and skepticism. Yet, transparent progress reports and community engagement have sustained most of Pi’s momentum. Observers note that, should Pi deliver on its core-use case promises, the project may still break new ground in mass-market crypto adoption.

Conclusion: Is Pi Network’s Exchange Launch Near?

The question of when Pi Coin will officially be listed on major exchanges remains unresolved as mid-2024 approaches. Pi Network’s unique, slow-and-steady strategy—the antithesis of the typical “hype launch”—means concrete developments only arrive when security, compliance, and ecosystem growth targets are met. While rumors and unofficial listings persist, savvy users will wait for final confirmation from the Pi Core Team and reputable exchanges before engaging with converted Pi tokens.

Anyone interested in Pi’s exchange future should closely monitor official channels, remain wary of third-party offers, and reflect on the historical lessons of both failed and successful network launches. The eventual Pi Coin listing date could become a major event in the cryptocurrency sector—but until all prerequisites are met, prudent patience remains the wisest course.

FAQs

When is the official Pi Coin listing date?

As of June 2024, there is no officially confirmed listing date for Pi Coin on any exchange. The Pi Core Team has stated that the open mainnet—and any associated listings—will only occur after mass KYC and ecosystem development milestones are complete.

Are Pi Coin IOU tokens on exchanges real?

No. Any Pi Coin trading pairs or IOU tokens listed by secondary exchanges before the official open mainnet do not represent actual Pi and are strongly discouraged by the Pi Core Team. Engaging with such markets involves significant risk.

What needs to happen before Pi Coin can be listed on exchanges?

The main prerequisites include widespread completion of KYC, robust network security, full ecosystem deployment, and compliance with exchange listing requirements. All these steps are necessary to protect users and support a fair launch.

How can users stay informed about the real listing date?

Follow updates via the official Pi Network app and verified social media channels. Avoid relying on unofficial groups or speculative news, and always cross-check with communications from the Pi Core Team.

Will Pi Coin’s price be set by the developers or open market?

Upon official listing, Pi Coin’s price will be determined by free market supply and demand, not set by the developers. Any price seen before open mainnet is purely speculative and not endorsed by the Pi Network team.

What are the risks of rushing into Pi Coin before the official exchange launch?

Entering unofficial Pi markets exposes users to potential scams, loss of funds, and unsupported assets. The safest approach is to await official mainnet and exchange confirmations to ensure the legitimacy of all transactions.