Cardano (ADA) has consistently ranked among the top cryptocurrencies, valued for its scientific approach and strong development team. As the crypto market matures, investors and analysts are turning their attention toward future price movements, with “prediksi harga Cardano 2025” becoming a frequently searched phrase. This article examines the various factors that could influence ADA’s value by 2025, offering not only an exploration of technical analysis but also considering macro trends, development roadmaps, and real-world adoption.

Understanding Cardano’s Foundation

Founded by Charles Hoskinson, one of Ethereum’s co-founders, Cardano aims to solve major blockchain limitations—scalability, sustainability, and interoperability—through an academic, peer-reviewed process. Its unique proof-of-stake (PoS) protocol, called Ouroboros, has won praise for energy efficiency and security. Unlike many “Ethereum killers,” Cardano rolls out upgrades gradually, prioritizing network robustness over flashy product launches.

Roadmap Achievements and Upcoming Upgrades

So far, Cardano has accomplished several milestones:

- Shelley: decentralization of stake pools

- Goguen: implementation of smart contracts

- Basho: focus on scalability improvements

Looking ahead, Cardano’s growth depends heavily on further smart contract ecosystem expansion, sidechain deployment, and interoperability features, as outlined in its Basho and Voltaire phases. Progress here shapes both sentiment and real economic value, foundational elements for long-term price predictions.

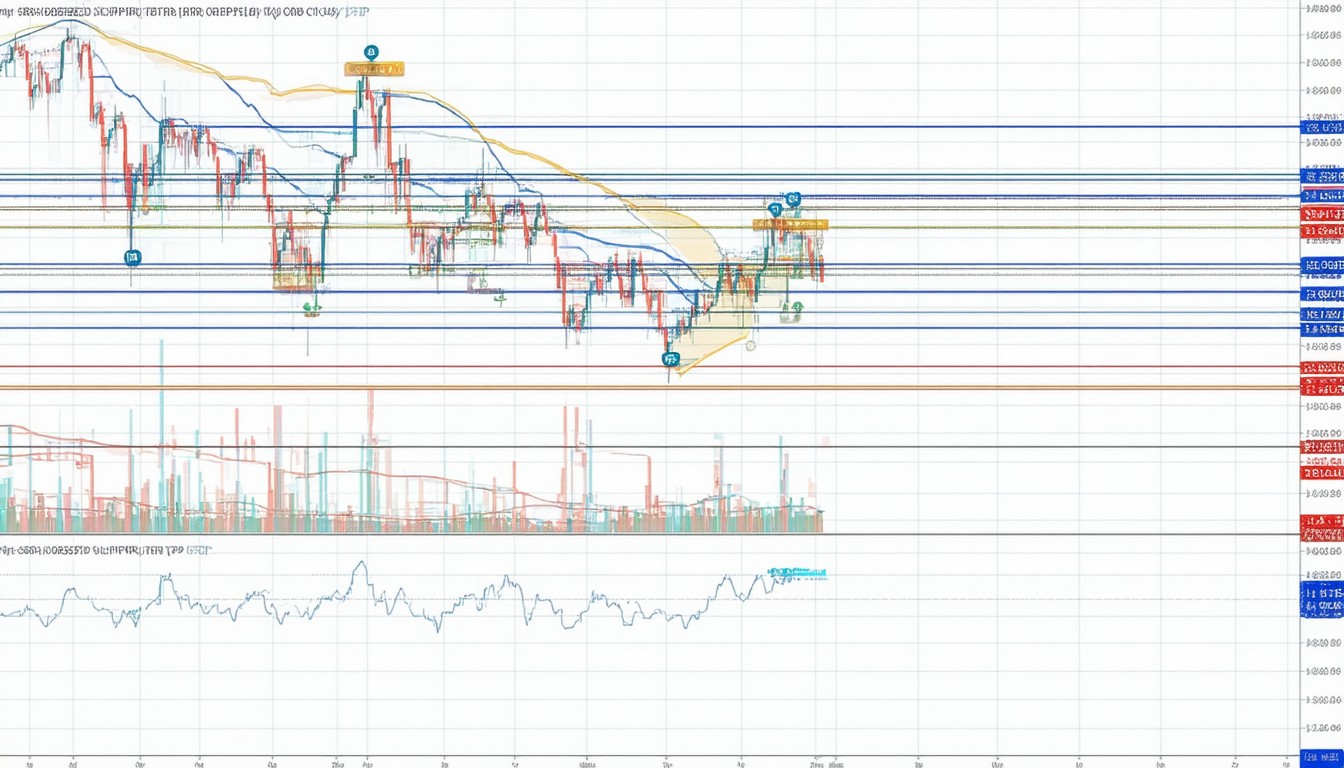

Technical Analysis: Price Patterns and Historical Volatility

Price prediction in crypto is as much art as science. ADA, like many altcoins, is known for periods of high volatility. After peaking above $3 in 2021, ADA saw sharp corrections, reflecting wider market cycles. However, since late 2023, Cardano has shown resilience relative to many other Layer-1 blockchains.

Key Patterns and Support Levels

Analysts commonly use the following when assessing ADA price prospects:

- Moving averages (50-day, 200-day): Identify momentum changes

- Fibonacci retracement levels: Help spot potential support/resistance

- On-chain metrics: Track wallet activity, staking participation, and network growth

For 2025, much will depend on ADA’s ability to retain critical support—many technical models emphasize $0.30–$0.50 as a base, with a potential to revisit prior highs (north of $2) in bullish scenarios. Still, these projections are highly sensitive to overall crypto market sentiment.

“Long-term price moves for ADA will largely hinge on Cardano’s smart contract adoption, alongside how well the network can differentiate itself as Ethereum competitors mature,”

– Many blockchain analysts

Macro Trends Impacting Cardano’s Price Outlook

Crypto does not exist in a vacuum. Several external forces will help define whether ADA can outperform or lag in the coming years.

Institutional Adoption and Regulatory Clarity

A broad increase in institutional crypto interest tends to favor established platforms. Cardano’s environmental credentials (due to its PoS foundation) and reputation for academic rigor position it well if ESG (environmental, social, and governance) investment standards become the norm. However, regulatory risks linger—especially for altcoins not as entrenched as Bitcoin or Ethereum.

Real-World Use Cases and DeFi/NFT Ecosystem Growth

Cardano must cultivate actual blockchain utility. Competing ecosystems—Ethereum, Solana, Avalanche—already support thousands of decentralized applications (dApps). For ADA to break new ground, adoption by developers, DeFi users, and even governments (see partnerships in Africa and with educational platforms) must take off.

By 2025, investor confidence could rise sharply if high-profile applications launch successfully on Cardano, or if the chain plays a foundational role in digital ID, supply chain, or global financial access.

The Bitcoin Effect and Market Correlations

In practice, all cryptocurrencies remain closely correlated with Bitcoin price cycles, albeit to varying degrees. Any “prediksi harga Cardano 2025” must acknowledge that macro crypto market sentiment—and particularly Bitcoin’s trajectory post-halving cycles—will likely set broad uptrend or downtrend conditions for ADA.

Cardano vs. Other Layer-1 Blockchains

Investors often evaluate ADA in comparison with other smart contract networks. Some major points of comparison include:

Strengths

- Robust peer-reviewed development: Increases long-term reliability.

- Eco-friendliness: Attracts ESG-conscious investors.

- Active staking community: Encourages holding and network security.

Weaknesses and Risks

- Slow development pace: Seen as cautious, but can also hamper user and developer growth.

- Competition: Rapid evolution in Solana, Avalanche, and Ethereum’s in-progress upgrades.

Market Position in 2025

If Cardano fails to attract developers and usage, ADA risks stagnation or declining dominance. Conversely, successful dApp launches or high-impact government partnerships could see Cardano re-emerge as a top-three blockchain in terms of total value locked or active addresses.

Expert Insights and Future Scenarios for Cardano 2025

Market experts emphasize the many variables at play. Optimistic scenarios often cite ADA’s potential for double- or triple-digit percentage gains if the next crypto bull cycle aligns with real Cardano network growth. Pessimistic forecasts, on the other hand, stress the risk of being “left behind” in the ongoing Layer-1 innovation race.

“Predicting ADA’s exact price by 2025 requires humility: while Cardano’s technical backbone is outstanding, it must translate this into real-world use and developer enthusiasm to justify further upside,”

– Crypto market strategist commentary

Strategic Considerations for ADA Investors

Anyone considering ADA as a long-term investment should carefully weigh the following:

- Monitor upgrade delivery and ecosystem activity: Active development and expanding dApp usage are bullish indicators.

- Watch for regulatory signals: Changes in global crypto law could impact ADA’s listing and use.

- Diversify exposure: Pair ADA with other top blockchain assets to manage project-specific risks.

- Stay realistic about volatility: Even in positive scenarios, double-digit corrections or lulls may persist.

Above all, success for ADA by 2025 likely hinges not just on Cardano’s internal progress but broader acceptance by users and institutional players. This is something that cannot be predicted with certainty but can be tracked through network metrics and ecosystem news.

Conclusion

The “prediksi harga Cardano 2025” is shaped by a complex interplay of factors—core technology, execution, market trends, and macro events. Cardano’s strengths lie in its scientific approach, active community, and promise of sustainability and scalability. However, its future price will depend on tangible adoption, competition from other platforms, and overall crypto market cycles.

Savvy investors should focus less on chasing short-term price targets and more on monitoring Cardano’s developmental milestones and ecosystem health. Given the rapidly evolving landscape, continued research and measured optimism remain the best strategies.

FAQs

What factors are most likely to influence Cardano’s price by 2025?

Cardano’s price will likely depend on successful network upgrades, developer and user adoption of Cardano-based dApps, shifts in crypto regulation, and broader market trends led by Bitcoin and Ethereum.

How does Cardano differentiate itself from competitors like Ethereum and Solana?

Cardano emphasizes a scientific, peer-reviewed development methodology and strong energy efficiency due to its proof-of-stake approach. However, its slower rollout of features can be a double-edged sword compared to faster-moving competitors.

Is ADA a good long-term investment compared to other cryptocurrencies?

ADA offers strong potential due to its network design and sustainability focus, but like all altcoins, it carries considerable risk. Diversification and awareness of Cardano’s ecosystem progress are key.

What are the main risks facing Cardano in the next few years?

Risks include slow developer adoption, regulatory uncertainties, and competition from other blockchains with more active ecosystems or faster innovation cycles.

How volatile could ADA’s price be before and during 2025?

ADA has historically exhibited high price volatility. Large rallies and corrections are possible, especially in tandem with broader crypto cycles and developments within Cardano’s ecosystem.